Financial behavior is shaped by processes that often operate below conscious awareness. This article examines how Subconsciously Vs Unconsciously biases influence spending decisions and what that means for everyday budgeting.

Subconsciously Vs Unconsciously: Understanding Biases That Shape Spending

Subconsciously Vs Unconsciously influences come from how the brain processes information before a purchase is even considered. By recognizing that these forces exist, you can begin to separate reflexive reactions from deliberate planning, making it easier to allocate money in line with your goals rather than chasing the latest deal.

In practice, Subconsciously Vs Unconsciously biases can affect what you notice about a product, how you evaluate its value, and when you decide to buy. Small cues—a price tag, a limited-time offer, or a familiar brand—can trigger a chain of thoughts that skews judgment without you realizing it. Awareness is the first step toward smarter spending.

Key Points

- Subconsciously Vs Unconsciously biases often operate before a person is fully aware, shaping perceived value and urgency.

- Framing, defaults, and social proof are common triggers that retailers use to guide choices.

- Identifying your patterns builds the foundation for actionable routines that curb impulsive spending.

- Emotional states amplify these biases; managing mood and stress supports steadier budgeting.

- Simple, repeatable tools—like time delays and spending journals—can realign purchases with long-term goals.

How Subconsciously Vs Unconsciously Biases Show Up

Subconsciously Vs Unconsciously factors show up as quick judgments about value, need, and risk. Anchoring can make a first price feel like a baseline, while loss aversion might push you to buy now to avoid the regret of missing out. These processes operate alongside conscious decisions, often tipping the balance toward spending you later question.

Strategies to Manage Subconsciously Vs Unconsciously Biases

Several practical tactics help counter bias-driven spending while keeping you productive and sane:

- Pause before purchases and set a personal rule—such as waiting 24 hours for non-urgent items.

- Use a structured budget with explicit categories and caps to create clear anchors for your spending.

- Compare prices and value beyond headline discounts to avoid framing tricks.

- Track purchases with a quick journal to reveal patterns linked to mood, place, or time of day.

- Build automated safeguards, like savings funnels, that redirect money away from impulse buys.

By implementing these steps, you can turn awareness of Subconsciously Vs Unconsciously biases into practical discipline, shaping spending that supports long-term goals rather than short-term thrills.

What is the difference between subconsciously and unconsciously in spending?

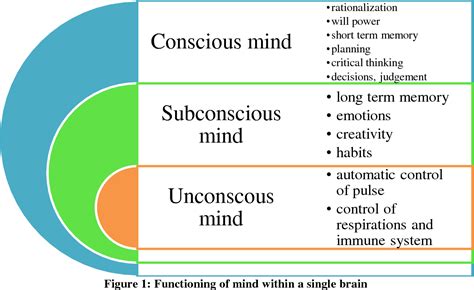

+Subconsciously refers to mental processes that occur below awareness but can still be influenced by immediate cues. Unconsciously implies deeper processing that operates beneath both awareness and deliberation, often shaping core beliefs and long-standing habits. In spending, subconscious cues may trigger quick impulses, while unconscious patterns can steer broader budgeting choices over time.

How can I identify biases affecting my spending?

+Begin by tracking purchases and noting what triggered them—was it a sale banner, a suggestion from a friend, or fatigue after a long day? Look for recurring patterns: times of day, emotional states, or places where you spend more. Journaling and simple data collection over a few weeks often reveal Subconsciously Vs Unconsciously influences you weren’t aware of.

What practical steps help reduce bias-driven spending?

+Practices like a 24-hour rule for non-urgent buys, creating specific budget limits, and using price comparison tools can counter bias effects. Pair these with a simple spending journal to track when and why purchases occur, then adjust your routines based on what you learn.

Can these biases be turned into better financial outcomes?

+Yes. If you acknowledge Subconsciously Vs Unconsciously influences and design routines that favor intentional choices, you can convert potential bias into discipline. Framing your goals, automating savings, and creating decision checklists helps align spending with values, not just momentary appeal.